I think we have all been reading the headlines and feeling the impact of the rapid rise in variable interest rates. However, the 5-year fixed rates are now tracking about 120 basis points below the variable rates. Steve Huebl from Canadian Mortgage Trends provides some insight as to where this might be leading us.

While rates have been steadily climbing for variable mortgages, fixed mortgage rates have been moving in the opposite direction.

Certain lenders and national brokerages have been gradually dropping rates for select terms since the start of the month. Average nationally-available deep-discount 5-year fixed mortgage rates are now about 20 basis points lower compared to earlier in the month, according to data from MortgageLogic.news.

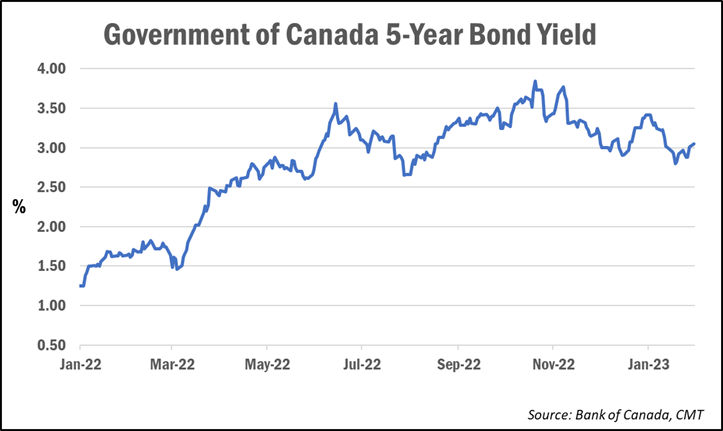

The move follows the recent decline in the 5-year Government of Canada bond yield, which typically leads fixed mortgage rates.

The 5-year bond yield closed at 3.05% on Monday, bouncing back slightly from a 5-month low of 2.80% reached last week. Still, yields are down from about 3.40% four weeks ago and the 14-year high of 3.89% reached in October.

Could this be a peak for fixed rates?

While this isn’t the first time fixed mortgage rates have dipped in recent months, some suggest that with expectations of a recession on the horizon and with the worst of inflation seemingly behind us, rates could continue to ease some more.

“It certainly looks to me like we’re starting to bump up against some resistance on fixed mortgage rates,” Ben Rabidoux of Edge Realty Analytics said during a webinar for clients on Monday. “I think there is a very good chance that we’ve seen the peak in fixed mortgage rates and they’re now beginning to decline.”

He pointed to the “highly unusual” fact that fixed rates are now priced about 120 basis points (or 1.2 percentage points) below variable rates.

“That’s an indication that the rates market is projecting Bank of Canada rate cuts later this year,” he said. “This helps explain why fixed rates are lower than variable because the fixed rates are priced off the bond market…[and] the bond market is clearly signalling that the worst of the inflation scare is behind us.”

If the current trend continues, Rabidoux said that there’s a “very good chance” that 5-year fixed rates fall back to the “low fours” by the spring homebuying season.

“If [yields] continue to tick down a little, the possibility that we end up with mortgages in the high threes is not outside the realm of possibility at this point,” he added. “A lot can change, but as it stands right now, I think the direction of travel for interest rates is clearly down and that’s good news.”

Short-term fixed rates growing in popularity

Many borrowers are clearly anticipating lower rates again in the coming years, which explains the rising popularity of short-term fixed rates.

Data from the Bank of Canada shows a clear trend of borrowers shifting away from variable rates and towards short-term fixed rates.

Nearly a third (31%) of all new mortgage originations as of November had a fixed-rate term of under three years.

It’s a trend Rabidoux said he expects to continue, so long as expectations are for rates to come down in the near term.

“It makes sense. If I were taking out a mortgage today, I would be inclined to look at 1- or 2-year fixed because I think there’s a decent chance that, a year or two from now, [rates are] going to be substantially cheaper at renewal,” he said.

Meanwhile, after making up nearly 60% of new mortgage originations last year, variable-rate products are back to making up a more historically average share of new mortgages, according to the Bank of Canada data. In November, 22% of new originations had a variable-rate mortgage.

Written by: Steve Huebl_Canadian Mortgage Trends (published Jan 30/23)