We have seen a pause in the successive Bank of Canada Interest rates hikes and inflation seems to be slowing coming down. Is now the time to jump back into the housing market? Are home prices finally hitting the bottom? Storeys takes a look at whether the decline in home prices is losing steam and we are nearing the bottom.

Canadian home prices continued to tumble in February, according to new data, but there are signs that the bottom is near.

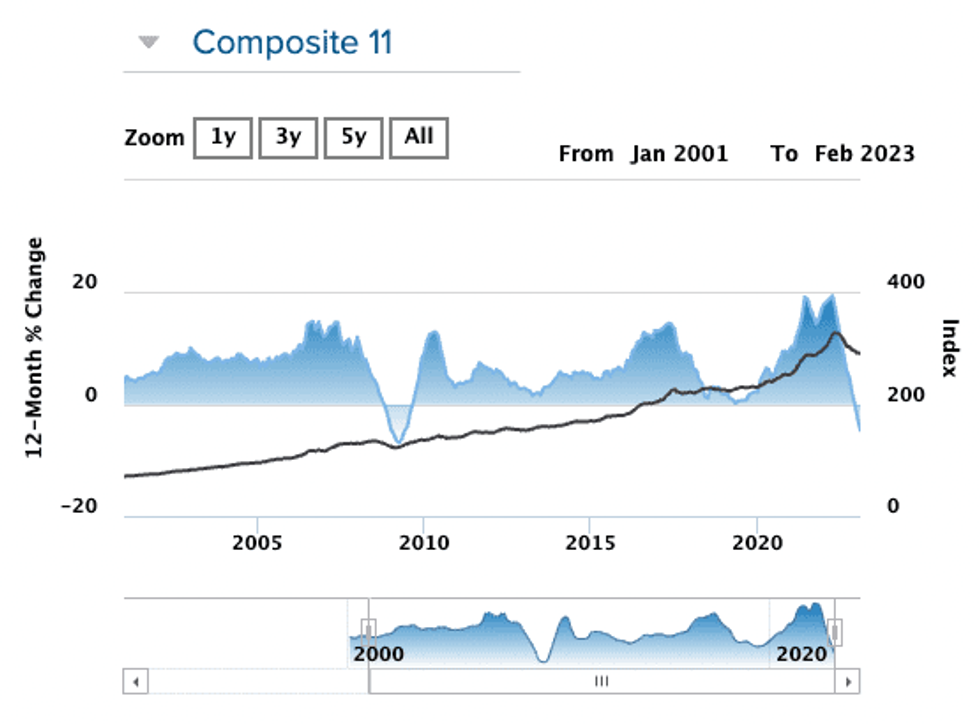

The Teranet-National Bank Composite House Price Index tracks observed or registered home prices across 11 CMAs: Victoria, Vancouver, Calgary, Edmonton, Winnipeg, Hamilton, Toronto, Ottawa-Gatineau, Montreal, Quebec City, and Halifax. All properties that have been sold at least twice are considered in the calculation of the index.

The latest index, released Friday, shows a 0.3% dip, before seasonal adjustments, between January and February. After adjusting for seasonal effects, the index was down 0.5%, marking the tenth consecutive monthly decline.

The index has been trending downwards for some time, but declines have progressively lost steam following a record-breaking drop of 3.1% in September. The decline observed in February was the most nominal yet. In fact, it was the slightest decline the index has seen since July 2022.

Prices depreciating at a slower pace supports the assertion that the bottom is likely near — something that has been corroborated by report after report. Last week alone, reports from the Canadian Real Estate Association, RBC, and Desjardins all came to a similar conclusion: prices are looking likely to bottom out soon, although there is still much debate as to when exactly that will be.

READ: Canadian Home Sales Have Slumped 40% From February Peak

Month over month, seven of the 11 CMAs examined by Teranet saw their indexes contract in February, including Toronto (-2.7%), Calgary (-2.4%), Halifax (-1.8%), Edmonton (-0.8%), Hamilton (-0.3%), Montréal (-0.3%), and Ottawa-Gatineau (-0.2%).

Additionally, price declines were observed in 11 of the 20 CMAs not included in the composite index, with Thunder Bay and Sherbrooke experiencing the steepest drops of 12.5% and 10.5%, respectively. The report also notes that Thunder Bay and Sherbrooke saw gains of 2.8% and 9% the month prior.

Conversely, prices increased during the month in Vancouver (+3.8%), Victoria (+1.9%), and Québec (+0.1%). Of the CMAs not included in the index, Trois-Rivières observed a gain of 7.7% in February, following a decrease of 9% the month prior, and Guelph saw a gain of 6.6%, following a decrease of 9.4% the month prior.

The index remained stable in Winnipeg.

Year over year, the national index fell 4.7% in February, marking the second straight month in which the metric was in “negative territory.”

Nonetheless, annual increases were observed in four of the 11 CMAs examined, with Calgary at the forefront with a gain of 8.8%. Quebec City trailed behind with a 5% gain and Edmonton also saw a 1.9% increase. Meanwhile, Hamilton, Toronto, and Vancouver dragged down the national composite, with declines of 14%, 8.8%, and 3.9%, respectively.

Amongst the 20 CMAs not considered in the index, positive annual gains were observed in five, with Trois-Rivières (+12.4%), and Saint John (+12.1%) leading the pack. Abbotsford-Mission, Guelph, and Thunder Bay saw the steepest declines, dropping 15.1%, 16.6%, and 17.5%, respectively.